Insurance

:

The pioneering telco to offer PA insurance

Get yourself covered

when you top up RM50 or more

monthly

Are you eligible for the coverage?

Check your eligibility by keying in your MyKad/Passsport No.

Do not insert “-” for MyKad No.

Note: The list will be updated on every 7th of the month.

How to enjoy PA Insurance coverage?

Top Up Now

Check Now

Cooling Period

Sheila’s number has been active for more than 2 months (60 days). She is qualified for the PA Insurance.

Top up ≥ RM50

Sheila performs a top up of RM10 five times (total RM50) in August.

Criteria is met

Sheila’s number is active and she is automatically covered in September!

Remain Eligible

Sheila continues to top up RM50 every month to be eligible.

Plan ahead and nominate your beneficiary (Optional)

Inform loved ones

Inform your nominees while awaiting confirmation.

Supporting documents

Prepare all the additional documents for further procedures.

Notify within 30 days

Send your PA Claim Form and the supporting documents to rhbi.general@rhbgroup.com

03-95458888

Top Up Now

Check Now

Cooling Period

Sheila’s number has been active for more than 2 months (60 days). She is qualified for the PA Insurance.

Top up ≥ RM50

Sheila performs a top up of RM10 five times (total RM50) in August.

Criteria is met

Sheila’s number is active and she is automatically covered in September!

Remain Eligible

Sheila continues to top up RM50 every month to be eligible.

Plan ahead and nominate your beneficiary (Optional)

Fill up info

Download the Nomination Form and fill in the details.

Email RHB Insurance

Send the nomination form to rhbi.general@rhbgroup.com.

Inform loved ones

Inform your nominees while awaiting confirmation.

Fill up info

Download the PA Claim Form and fill in the details.

Supporting documents

Prepare all the additional documents for further procedures.

Notify within 30 days

Send your PA Claim Form and the supporting documents to rhbi.general@rhbgroup.com

03-95458888

For incidents before 1-Nov-2024, click HERE

GPA Policy

Let’s switch now!

Psst... Get your brand new SIM from

Frequently Asked Questions (FAQs)

The PA Insurance provides coverage of RM50,000 in the event of death or total and permanent disability, including total paralysis.

It is absolutely FREE and the premium payment is borne by Tune Talk if you Top Up a minimum of RM50 monthly.

Coverage commences on the following month upon meeting the minimum monthly top up of RM50 for the current month, subject to the 60 days cooling-off period from the date you activate your Tune Talk SIM. (Example: if your cumulative top up for the month of January is RM50 or more, you will receive the FREE PA Insurance coverage for the following month of February)

Coverage commences on the first day of the month and ends on the last day of the month. (Example: 1st January until 31st January)

All benefits are paid in addition to and regardless of any other insurance policies you may have.

The exclusions and policy wording can be accessed and downloaded here.

You have to be not less than 12 years old and not more than 65 years old to be eligible for the PA Insurance coverage.

Even if you have multiple lines registered under Tune Talk, your coverage is limited to only one policy.

- Scuba Diving

- Martial Arts

- Racing (other than on foot)

- Ice Hockey

- Hunting

Please read through the exclusions in the policy carefully here for a comprehensive list of activities that are excluded from coverage

The PA Insurance does not cover the following, including but not limited to:

- Motorcycle-related accidents: Any incident where the subscriber is riding or pillion riding a motorcycle, regardless of the purpose.

- Situations other than death or total and permanent disablement, such as:

- Medical expenses

- Temporary disablement

- Hospitalization

You are eligible for the coverage if you top up RM50 or more anytime between the first day of every month (12:00am) till the last day of every month (11:00pm). (Example: 1st January (12.00am) – 31st January (11:00pm).

The 60 days cooling-off period is the excluded period for PA Insurance coverage for all newly activated Tune Talk number.

- Military and Law Enforcement

- Pilot and Aircrew

- Professional Sports

- Workers utilising wood-working machinery

Please read through the exclusions in the policy here for a comprehensive list of occupations that are excluded from coverage

For incidents after 1-Nov-2024

All claims must be notified within 30 (thirty) days from the date of accident, provide full particulars and shall seek medical or surgical advice as soon as possible. Please contact RHB Insurance Customer Service Hotline at 1300-220-007 to do this or seek more clarification on your claim enquiries.

Alternatively, you can download the claim form here and email it to rhbi.general@rhbgroup.com.

For incidents occurring on or before 31/10/24, please click HERE.

Eligibility to the PA Insurance coverage is subject to accuracy of subscriber’s personal information as per his/her Mykad/Passport/Police ID/Army ID entered at point of registration.

Pursuant to Section 129 and Para 5 of Schedule 9 of Financial Services Act 2013, Malaysia, nominee(s) should be: spouse, child or parent(s), if there is no spouse or child at the time of making the nomination, the nominee is his parent. A nominee of a Muslim insured person upon receipt of policy moneys shall distribute the policy moneys in accordance with the Shariah Laws.

For more information, kindly refer to Tune Talk’s website or call our customer care at 13100 / 03- 2771 7000 from 8am to 10pm.

Tune Talk reserves the right to amend the terms and conditions without prior notice.

The PA Insurance provides coverage of RM50,000 in the event of death or total and permanent disability, including total paralysis.

The PA Insurance does not cover the following, including but not limited to:

- Motorcycle-related accidents: Any incident where the subscriber is riding or pillion riding a motorcycle, regardless of the purpose.

- Situations other than death or total and permanent disablement, such as:

- Medical expenses

- Temporary disablement

- Hospitalization

It is absolutely FREE and the premium payment is borne by Tune Talk if you Top Up a minimum of RM50 monthly.

You are eligible for the coverage if you top up RM50 or more anytime between the first day of every month (12:00am) till the last day of every month (11:00pm). (Example: 1st January (12.00am) – 31st January (11:00pm).

Coverage commences on the following month upon meeting the minimum monthly top up of RM50 for the current month, subject to the 60 days cooling-off period from the date you activate your Tune Talk SIM. (Example: if your cumulative top up for the month of January is RM50 or more, you will receive the FREE PA Insurance coverage for the following month of February)

The 60 days cooling-off period is the excluded period for PA Insurance coverage for all newly activated Tune Talk number.

Coverage commences on the first day of the month and ends on the last day of the month. (Example: 1st January until 31st January)

- Military and Law Enforcement

- Pilot and Aircrew

- Professional Sports

- Workers utilising wood-working machinery

Please read through the exclusions in the policy here for a comprehensive list of occupations that are excluded from coverage

All benefits are paid in addition to and regardless of any other insurance policies you may have.

For incidents after 1-Nov-2024

All claims must be notified within 30 (thirty) days from the date of accident, provide full particulars and shall seek medical or surgical advice as soon as possible. Please contact RHB Insurance Customer Service Hotline at 1300-220-007 to do this or seek more clarification on your claim enquiries.

Alternatively, you can download the claim form here and email it to rhbi.general@rhbgroup.com.

For incidents occurring on or before 31/10/24, please click HERE.

The exclusions and policy wording can be accessed and downloaded here.

Eligibility to the PA Insurance coverage is subject to accuracy of subscriber’s personal information as per his/her Mykad/Passport/Police ID/Army ID entered at point of registration.

You have to be not less than 12 years old and not more than 65 years old to be eligible for the PA Insurance coverage.

Pursuant to Section 129 and Para 5 of Schedule 9 of Financial Services Act 2013, Malaysia, nominee(s) should be: spouse, child or parent(s), if there is no spouse or child at the time of making the nomination, the nominee is his parent. A nominee of a Muslim insured person upon receipt of policy moneys shall distribute the policy moneys in accordance with the Shariah Laws.

Even if you have multiple lines registered under Tune Talk, your coverage is limited to only one policy.

For more information, kindly refer to Tune Talk’s website or call our customer care at 13100 / 03- 2771 7000 from 8am to 10pm.

- Scuba Diving

- Martial Arts

- Racing (other than on foot)

- Ice Hockey

- Hunting

Please read through the exclusions in the policy carefully here for a comprehensive list of activities that are excluded from coverage

Tune Talk reserves the right to amend the terms and conditions without prior notice.

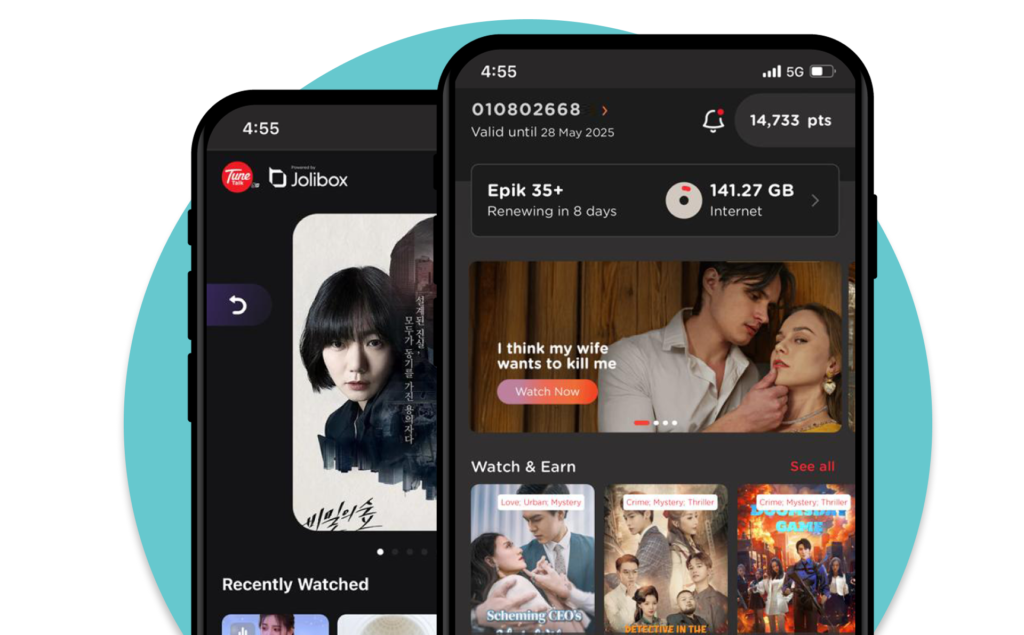

Free Insurance – Epik+ Plans

Get yourself covered with RM50,000 Personal Accident Insurance.

Find Out More